Who Are the Real Winners Under UPC?

While many had predicted that the introduction of the universal proxy card (UPC) would mean a boon for activists, after two years the evidence is more nuanced, with activists often appearing to face an even higher bar in order to win support for their candidates, writes Antoinette Giblin.

The Security and Exchange Commission’s (SEC) new regime for director elections was made applicable to all U.S. shareholder meetings held after August 31, 2022 and was widely expected to make proxy fights head-to-head contests between sitting directors and dissident candidates that activists would more often win, especially when advancing minority slates, due to the pick-and-mix menu presented.

However, activists targeting U.S. boards have come away with fewer seats including settlements since its rollout, with the figure decreasing from 176 in 2022 to 161 in 2023 and falling further to 155 in 2024, according to Diligent Market Intelligence (DMI) data.

Management shutouts

Adding to the anxiety for activists, management’s record in the bigger contests of 2024 appeared more solid. “One of the standout takeaways of the first two proxy seasons under UPC is that boards are still winning the vast majority of proxy fights. In fact, this season was probably one of the best for boards in the last decade,” Kai Liekefett, co-chair of Sidley’s shareholder activism & corporate defense practice, told DMI. “Even under the UPC, activists still need to have a compelling case for change and if they don’t, then they’re simply not going to win a proxy fight.”

In nine contests examined by DMI from the proxy season that ran from July 2023 to June 2024, activists had partial success in just one, where Ancora Advisors claimed three out of the seven seats it had sought at Norfolk Southern. In all eight others, management defended their boards shutting the door to dissident nominees.

Endorsements

For success in 2025, obtaining the support of the proxy advisory firms is considered critical to any board seat win. In the contests examined by DMI, Ancora Advisors was the only activist to secure the backing of Glass Lewis (for six of its seven nominees), while Institutional Shareholder Services (ISS) gave the nod to five Ancora candidates.

“Companies can overcome a negative ISS recommendation, but activists effectively need the support of at least one of the proxy advisory firms, and often both, in order to win a board seat,” said Dave Whissel, managing director at Spotlight Advisors.

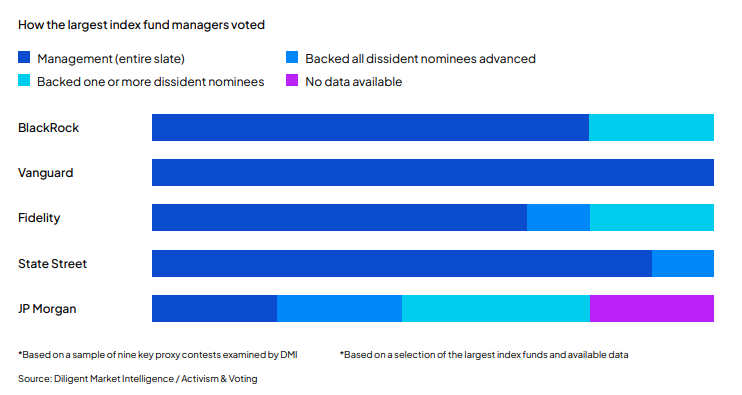

Indeed, in the three fights where ISS backed at least some dissidents, only at Norfolk Southern did the activist win seats. At Disney, Glass Lewis backed management, while ISS broke for Nelson Peltz. None of the top five asset management firms by assets backed a dissident nominee, according to DMI.

Steven Balet, partner at FGS Global, told DMI that getting the ISS recommendation does not necessarily mean an activist will win. “What you have to do is produce a report that speaks to the issues that are important to ISS and to their clients, which may differ in their views from ISS. We have seen where those clients will vote differently than the ISS recommendation, which is what happened in the case of Disney.”

Conversely, in a proxy contest at Masimo in September – after the cutoff for voting disclosures – Politan Capital Management won seats with the support of both proxy advisors.

Overall, asset management giant BlackRock gave its backing to management’s full slate in seven of the nine key contests examined by DMI, with Vanguard backing management in all nine contests, Fidelity in six and State Street in eight.

Indeed, research conducted by Spotlight Advisors has found that in proxy fights using the universal proxy card, BlackRock’s vote has aligned with the outcome more than 90% of the time. “The fact that the index funds continue to accumulate capital and represent a larger portion of the overall shareholder base is significant and, in my view, favors issuers,” concluded Whissel.

A never-ending season laden with new tacticsLooking ahead, as well as the impact of UPC and the importance of such key endorsements, the universe of activists is expected to expand and diversify with new tactics continuing to emerge including the creative use of technology and social media as seen in 2024. This saw Elliott deploy a new weapon in the form of a podcast series titled “Stronger Southwest” as it moved to control the messaging around its campaign for change at the airline. Proxy solicitor InvestorCom also observed the powerful influence of social media as it supported Focused Compounding in its board fight at Parks! America where the dissident secured four seats on the safari parks operator’s seven-person board at the June vote. “In much of that campaign, social media was used to communicate. It really got the word out to deliver a successful campaign and shareholders got to know FC better through those channels,” John Grau, CEO of InvestorCom, told DMI. Activist targets have also found new ways to communicate with their shareholders with Disney using its creative talents to release an animated video that saw Professor Ludvig Von Drake (the uncle of Donald Duck) bring its message to the media giant’s significant retail investor base. The timeline of campaigns is also expected to be more fluid as also evidenced last season. “We’re seeing attacks on companies right after their AGM. Activists aren’t waiting for the AGM for leverage, they aren’t waiting for the nomination window for leverage. They feel the leverage is available to them anytime because of what they can achieve through these new avenues,” concluded Balet. |

Distribution channels: Education

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release