Outsourced Finance and Accounting in New York: A Strategic Shift for Business Growth

Outsourced Finance and Accounting in New York help businesses streamline operations, ensure compliance, and drive growth.

Outsource finance functions to fuel your business growth and success! Click here

Rising inflation and tightening regulatory frameworks are putting pressure on businesses to streamline their financial processes. As labor shortages and rising operational costs add to the strain, the demand for outsourced finance and accounting services in New York has intensified. Companies are now focusing on the specialized expertise and flexibility that outsourcing offers, enabling them to adapt quickly to a volatile economic climate.

"The financial landscape is changing quickly, and businesses that do not adapt to shifting regulatory demands and market pressures could find themselves at a disadvantage," said Ajay Mehta, CEO of IBN Technologies. "Outsourcing finance functions helps companies mitigate risk, boost operational efficiency, and redirect internal resources towards fostering growth."

The mounting pressure of compliance, driven by stricter tax regulations and evolving financial frameworks, is becoming a formidable obstacle for many businesses. Organizations are being compelled to invest significant resources in meeting reporting standards, conducting thorough audits, and staying aligned with dynamic financial requirements. This often diverts valuable time and capital from strategic business priorities.

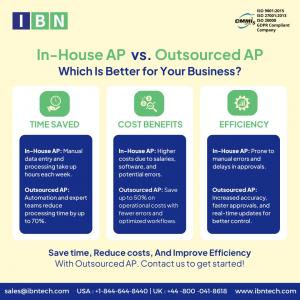

Concurrently, the cost of maintaining in-house finance teams, including the necessary infrastructure, software updates, and data protection protocols, has become unsustainable. In this context, outsourced finance and accounting solutions in New York present a strategic alternative, enabling businesses to maintain financial oversight and compliance while preserving quality and safeguarding security.

"Outsourcing finance functions not only reduces operational complexities but also empowers businesses to take a more strategic approach to financial decision-making," says Mehta. "It enables CFOs to shift their focus toward high-level analysis and long-term strategic planning."

Book your free 30-minute session to simplify your bookkeeping now!

https://www.ibntech.com/free-consultation/?pr=EIN

A major catalyst behind the growing adoption of outsourced finance services is the increasing sophistication of financial systems. Many businesses still rely on legacy accounting software that struggles with seamless integration, leading to inefficiencies in transaction handling and financial reporting. These operational bottlenecks result in delays, inaccuracies, and greater exposure to financial risks, all of which can undermine a company’s long-term stability and growth trajectory.

As businesses scale rapidly or experience seasonal fluctuations, they often struggle to adjust their financial operations to meet shifting demands. In such cases, outsourcing presents a scalable solution, enabling companies to realign their financial functions with evolving needs, ensuring continuity and efficiency even during uncertain periods.

In addition, outsourcing finance and accounting services offers a broad range of benefits, from reducing operational costs to ensuring compliance with rigorous regulations. Companies no longer need to make significant investments in maintaining large in-house finance teams; instead, they can access a network of financial experts specializing in areas such as bookkeeping services, tax preparation, payroll, and financial reporting.

Furthermore, outsourcing enables businesses to maintain financial flexibility, allowing them to scale operations up or down as needed without the burden of managing an internal team. Whether navigating periods of growth or economic contraction, outsourced finance and accounting in New York offers the agility necessary to keep financial operations running smoothly and efficiently.

Notably, outsourced finance and accounting solutions are becoming increasingly customized to meet the distinct needs of various industries. In the healthcare sector, for example, these services ensure compliance with HIPAA regulations while streamlining revenue cycle management. Similarly, real estate businesses benefit from automated lease accounting and tax optimization, while retail and e-commerce companies rely on outsourced services for tax automation and inventory reconciliation.

Ready to know your costs? Request a pricing quote for bookkeeping now!

https://www.ibntech.com/pricing/?pr=EIN

The manufacturing and logistics sectors are increasingly leveraging outsourcing to optimize supply chain costs, ensure tax compliance, and reduce financial risks, while enhancing overall efficiency. Outsourcing providers like IBN Technologies offer customized financial strategies to meet the unique needs of various industries, allowing businesses to streamline operations and focus on strategic goals such as market expansion, mergers, and product development.

The trend of outsourcing financial tasks has expanded globally, with businesses increasingly turning to India for its highly skilled professionals and cost-effective solutions. Companies benefit from enhanced accuracy, streamlined processes, and compliance with global standards while ensuring robust data security. India-based outsourcing firms, such as IBN Technologies, are equipped to meet the demands of global markets, offering 24/7 services and leveraging time zone advantages to provide continuous support for their clients.

IBN Technologies, a leading solution provider, plays a pivotal role in helping businesses in New York stay competitive by offering reliable, cost-effective outsourced finance and accounting services. With their expertise, companies can reduce risks, improve operational efficiency, and effectively navigate the complexities of financial management. As more businesses turn to outsourced finance solutions, IBN Technologies customized services are increasingly critical in driving long-term success and stability for New York's business community.

Source Link:

https://www.ibntech.com/article/outsourced-finance-and-accounting-services-usa/?pr=EIN

Related Services:

Catch-up Bookkeeping/ Year End Bookkeeping Services

https://www.ibntech.com/ebook/catch-up-bookkeeping-guide-for-financial-and-tax-success/?pr=EIN

AP/AR Management

https://www.ibntech.com/accounts-payable-and-accounts-receivable-services/?pr=EIN

Tax Preparation and Support

https://www.ibntech.com/us-uk-tax-preparation-services/?pr=EIN

Payroll Processing

https://www.ibntech.com/payroll-processing/?pr=EIN

USA Bookkeeping Services

https://www.ibntech.com/bookkeeping-services-usa/?pr=EIN

About IBN Technologies

IBN Technologies LLC, an outsourcing specialist with 25 years of experience, serves clients across the United States, United Kingdom, Middle East, and India. Renowned for its expertise in RPA, Intelligent process automation includes AP Automation services like P2P, Q2C, and Record-to-Report. IBN Technologies provides solutions compliant with ISO 9001:2015, 27001:2022, CMMI-5, and GDPR standards. The company has established itself as a leading provider of IT, KPO, and BPO outsourcing services in finance and accounting, including CPAs, hedge funds, alternative investments, banking, travel, human resources, and retail industries. It offers customized solutions that drive efficiency and growth.

Pradip

IBN Technologies LLC

+1 844-644-8440

sales@ibntech.com

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Distribution channels: Business & Economy

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

Submit your press release