From Santro to SUVs to EVs: Can Hyundai now deliver for investors like Maruti did?

Between FY21 and FY24, Hyundai Motor India’s net profit jumped over 3x and its operating margin expanded from 10.4% to 13.1%. The stock is already valued at ~24x earnings, close to Maruti’s historic average. With margins near their peak and competition intensifying, the question is: can Hyundai grow and deliver consistent shareholder returns, like Maruti once did?

The first phase of the Talegaon plant that Hyundai bought from GM is expected to be operational by Q4 of CY25, just as Hyundai plans to launch the Creta EV (pictured) and other new models. This timing isn’t coincidental. (Credit: Hyundai website)

The first phase of the Talegaon plant that Hyundai bought from GM is expected to be operational by Q4 of CY25, just as Hyundai plans to launch the Creta EV (pictured) and other new models. This timing isn’t coincidental. (Credit: Hyundai website)For most of the last two decades, Hyundai has been the second-largest carmaker in India. It launched Santro, i10, and Creta but never quite matched the investor buzz or market cap of Maruti Suzuki.

Yet behind the scenes, something has changed.

Between FY21 and FY24, Hyundai Motor India’s net profit jumped over 3x, operating margin quietly expanded from 10.4% to 13.1%, and average selling prices rose by nearly 40%.

The big missing piece? Capacity.

Hyundai ran at 95-100% utilisation for years, but it was unable to fully capitalise on demand, especially in its high-margin SUV portfolio. That bottleneck is now being removed with the acquisition of GM’s Talegaon plant; Hyundai’s capacity will rise from ~824,000 units to over 1.07 million, giving it the firepower to scale volumes like never before.

Add to that an aggressive EV roadmap (Creta EV in 2025 and two more EVs lined up), dominance in mid-size SUVs (~38% share), a rising export play (21% of volumes), and rising CNG penetration in models like Exter and Aura.

The stock is already valued at ~24x earnings, close to Maruti’s historic average. With margins near their peak and competition intensifying, the big question is whether Hyundai can grow and deliver consistent shareholder returns, like Maruti once did.

Let’s break it down.

Figure 1: Hyundai India’s Broad Business Highlights. Source: Quarterly Report Dec 24

Figure 1: Hyundai India’s Broad Business Highlights. Source: Quarterly Report Dec 24

From fast follower to global aspirant: Hyundai’s next big leap

For much of the last two decades, Hyundai Motor India (HMIL) operated with quiet efficiency. It was rarely the loudest brand in the room, but almost always one of the most visible on the roads, thanks to consistent product launches, well-timed marketing, and strong after-sales service. The Santro, i10, Verna, and Creta became household names.

But until recently, Hyundai’s strategy was still largely seen as that of a fast follower: enter growing segments, compete on quality and features, and ride on the global capabilities of Hyundai Motor Corporation (HMC), its Korean parent.

That playbook is now evolving, and the shift is visible not just in Hyundai’s cars but also in its ambitions.

Dominance in the segments that matter

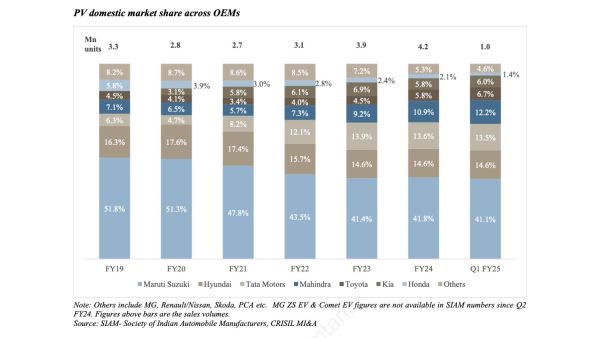

Hyundai holds a ~15% market share in India’s passenger vehicle industry, a figure that has remained stable over the past four years. At first glance, it may appear flat. However, a closer look reveals that Hyundai is heavily focused on the fastest-growing parts of the market: SUVs and premium compacts.

Figure 2: Hyundai India’s Market Share. Source: HMIL’s IPO DRHP

Figure 2: Hyundai India’s Market Share. Source: HMIL’s IPO DRHP

While the industry’s SUV+MPV mix is around 53%, Hyundai’s portfolio comprises nearly 63% UVs as of FY24. That’s no coincidence, as it is the result of a deliberate shift in focus from entry-level hatchbacks (like the now-discontinued Santro) to value-added crossovers and feature-rich SUVs.

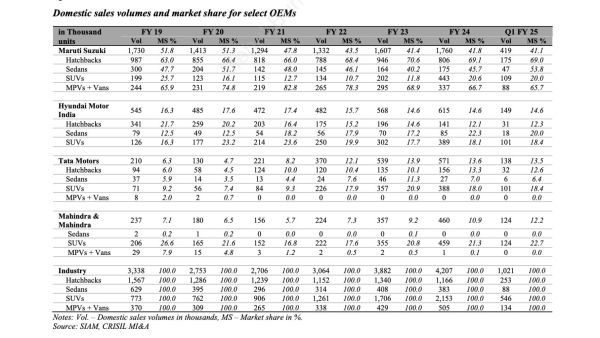

Figure 3: Various Companies Portfolio with Market Share. Source: HMIL’s IPO DRHP

Figure 3: Various Companies Portfolio with Market Share. Source: HMIL’s IPO DRHP

The Creta remains the undisputed leader in the mid-size SUV category, commanding a 34% market share. In compact SUVs, the Venue has carved out a solid 20% presence, while in premium hatchbacks, the i20 continues to hold an 18% share.

As India’s consumer moves up the value chain, Hyundai has strategically positioned itself at every meaningful price point between Rs 8 lakh and Rs 20 lakh, offering products that combine technology, safety, and design in equal measure.

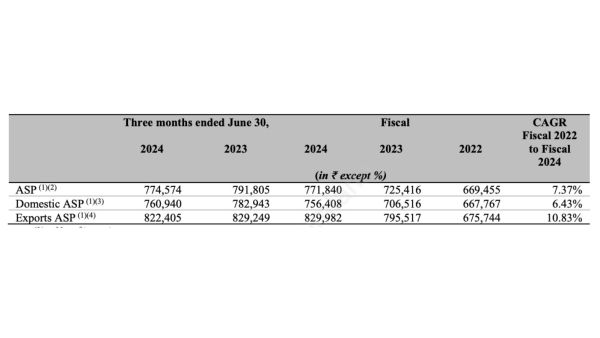

And buyers have responded. Average selling prices for Hyundai cars have risen significantly, from around Rs 6.7 lakh in FY22 to Rs 8.9 lakh in Q3 of FY25, despite only a moderate increase in volumes. This premiumisation has allowed Hyundai to expand its margins despite modest revenue growth.

Figure 4: HMIL’s Average Selling Price. Source: HMIL’s IPO DRHP

Figure 4: HMIL’s Average Selling Price. Source: HMIL’s IPO DRHP

The premium strategy comes of age

What sets Hyundai apart in today’s market is its breadth of offerings and the depth of features packed into them. It was one of the first to democratise sunroofs in compact cars, introduce turbocharged petrol engines in small crossovers, and now, offer ADAS (Advanced Driver Assistance Systems) in mass-segment sedans like Verna.

As per Motilal Oswal, ADAS-equipped models now account for 12.9% of Hyundai’s overall sales, up from just 3.4% a year ago. Sunroof penetration is even more striking, with over 53.5% of Hyundai’s sales in Q3FY25 including this once-premium feature, a steep rise from 47% the previous year. Packed with modern tech, the company’s ability to upsell higher trims has become a core lever for margin expansion.

First-time buyers, too, are leaning into Hyundai’s premium play. According to company data, over 40% of Hyundai buyers are first-time car owners, a jump from 33.6% just two quarters ago. In micro SUVs like the Exter and Venue, that ratio touches nearly 47%. These numbers suggest that Hyundai’s aspirational brand positioning is resonating even with entry-level buyers, many of whom are skipping hatchbacks for compact SUVs.

A moat built on platform agility and global R&D

Hyundai’s ability to adapt is rooted in something deeper: the backing of its global parent, HMC. Unlike most other Indian OEMs that build everything in-house or rely on foreign joint ventures, Hyundai India benefits from full access to Hyundai Motor’s global R&D, platforms, and powertrains. This structural advantage dramatically reduces lead times for new launches, allows for cost efficiencies across multiple markets, and ensures that Hyundai India is never too far behind global trends.

Globally, HMC has invested over $20 billion in R&D between 2014 and mid-2024, spanning EVs, shared mobility, autonomous driving, and new energy powertrains. That innovation funnel is already being localised. The Ioniq 5 and Ioniq 6, while low-volume halo products in India, are evidence of Hyundai’s electric readiness. The company’s latest bet — the Creta EV is expected to be the first true mass-market electric SUV from Hyundai’s Indian operations, launching in FY25.

Hyundai has also laid the foundation for localised EV production.

It has tied up with Exide for cell sourcing, is setting up local battery assembly, and plans to domesticate key components like power electronics and drivetrains. The goal isn’t just to compete in EV volumes, it is to be profitable while doing so. That long-term lens, coupled with Hyundai’s CNG (15% of volume) and diesel (19%) offerings, makes it one of the few automakers with a diversified and hedged powertrain strategy.

Solving the capacity constraint: Hyundai’s quiet gamechanger

For all its product success, Hyundai’s biggest limitation in recent years has been physical: not enough room to grow. With both its Chennai plants running at over 95% capacity utilisation, Hyundai has long operated under a self-imposed ceiling, unable to fully capitalise on booming demand for SUVs like the Creta and Venue.

This is now changing.

In 2023, Hyundai acquired General Motors’ idle Talegaon plant in Maharashtra. Once ramped up, this facility will add an incremental 250,000 units annually to Hyundai’s existing ~824,000-unit capacity. That takes its potential output past 1.07 million vehicles per year, putting it in Maruti’s league from a production standpoint.

The first phase (170,000 units) of the Talegaon plant is expected to be operational by Q4 of CY25, just as Hyundai plans to launch the Creta EV and other new models. This timing isn’t coincidental. Hyundai is aligning its product pipeline with capacity onboarding, a strategy ensuring each new model has enough headroom to scale for domestic sales and exports.

This expansion isn’t just about volumes. It’s about flexibility. Hyundai can now allocate capacity more strategically. Chennai can focus on high-margin SUVs and EVs, while Talegaon services scale products and new export demand.

Export engine reloaded: India as a global launchpad

Exports have always been an important part of Hyundai’s India story. In the 2000s, it was the first brand to turn India into a small-car export hub, shipping models like the i10 and i20 to Europe and Latin America.

While exports dipped during the post-2015 domestic boom, falling to ~104,000 units in FY21, they’ve been steadily recovering since. As of FY24, Hyundai’s exports stood at 160,000+ units, contributing 21% of total volume and 24% of revenue.

More importantly, Hyundai isn’t just exporting more cars, it’s exporting smarter. It is diversifying its geographical footprint by pushing deeper into Africa and Latin America. Exports to Africa grew 15% YoY in Q3FY25, partially offsetting a 10% drop in West Asia shipments caused by Red Sea disruptions.

The plan now is to use the additional Talegaon capacity to expand this footprint further, with Hyundai explicitly stating its intent to evaluate export potential for new EV models like the Creta EV. The goal is to grow international volumes and build a resilient, margin-accretive export mix that can buffer domestic cyclicality.

Powertrain hedging: Hyundai’s bet on ‘everything at once’

In a market where fuel preference is a moving target, Hyundai’s approach is refreshingly agnostic. It isn’t betting entirely on EVs, nor retreating from ICE. Instead, it’s executing a hedged strategy across five formats: petrol, diesel, CNG, hybrid (potential), and EV.

As of FY24:

- 65% of Hyundai’s volumes were petrol

- 19% were diesel, mostly in SUVs like Creta and Alcazar

- 15% were CNG, up from just 11% a year ago

This rise in CNG share is driven by the introduction of factory-fitted dual-cylinder options in cars like the Exter and Aura. For instance, 36.5% of Exter’s Q3FY25 sales were CNG variants, while CNG penetration in Aura touched a staggering 90%.

EVs are next. Although in premium niches, Hyundai has already launched the Ioniq 5 and Kona. However, the real EV play begins with the Creta EV, scheduled for Q4FY25, followed by two more EV launches by FY27.

Hyundai’s EV plan is interesting because it focuses on profitability, not just volume. It aggressively localises the EV supply chain, assembles battery packs, sources cells via a tie-up with Exide, and localises key components like power electronics and drivetrains.

Hyundai wants EVs to be margin-accretive in the long term, not loss leaders. And with 1.1 million units of installed capacity by FY26, it will have the room to build scale gradually.

Financials: A margin machine in motion

Hyundai’s recent financial performance makes its aspirations more than just strategy — it’s backed by execution.

Between FY21 and FY24:

- Revenue rose from Rs 40,972 crore to Rs 69,829 crore, a ~19% CAGR

- PAT rose from Rs 1,881 crore to Rs 6,060 crore, a 3.2x jump

- EBITDA margins expanded from 10.4% to 13.1%

- PAT margins rose from 4.6% to 8.7%, putting Hyundai among India’s most profitable auto OEMs

Much of this was driven by a richer sales mix (more SUVs, higher trims), improving cost controls, and stable commodity prices post-COVID. Hyundai’s average selling prices (ASP) climbed by 27% to nearly Rs 9 lakh.

Simply put, Hyundai is not just growing — it’s compounding with efficiency.

Valuation: Can the stock keep up with the business?

With the IPO behind it, Hyundai Motor India is now a listed entity with increasing investor interest. As of April 2025, the stock trades at around Rs 1,700, giving it a P/E multiple of ~24x FY24 earnings. This is in line with Maruti Suzuki’s long-term average and just slightly below Tata Motors’ domestic valuation if one adjusts for JLR.

Is that fair?

On one hand, Hyundai’s margin profile, capital efficiency (40% ROE), and product mix suggest it deserves a premium over most other ICE-led OEMs. It leads in mid-size SUVs, has strong export momentum, and a credible EV/CNG portfolio. If earnings grow by 10% per share by FY27, and the market continues to value it at ~25x earnings, the implied share price would be:

- At 22x P/E: Rs 1,980

- At 25x P/E: Rs 2,250

- At 28x P/E: Rs 2,520

Note: This does not predict where the stock price could head. It’s just an if-then calculation for academic purposes.

These aren’t forecasts, just logical outcomes under different valuation assumptions.

However, any rerating beyond this will require Hyundai to break new ground either by gaining share in premium segments it currently lacks (MPVs, high-end EVs) or turning India into a truly scaled EV export hub.

Risks to this trajectory include:

- Rising input costs compressing margins

- Intensifying competition from Maruti, Tata, and Mahindra in both ICE and EVs

- Policy-driven tax distortions around hybrids or EVs

- Execution delays in ramping up Talegaon or new EV models

But if Hyundai executes as it has over the past three years, the stock needn’t rely on P/E expansion. Earnings growth alone could justify a 15-25% upside from current levels over the next two years.

The road ahead

Hyundai is no longer just a fast follower in India’s auto market. It has a differentiated playbook – built on design, tech, platform agility, and scale. With capacity constraints behind it, exports picking up pace, and a pragmatic fuel strategy, the company is entering an exciting phase.

Although it may never dominate the market like Maruti once did, Hyundai may not need to in a fragmented, premiumising, tech-led auto landscape.

All it needs to do is execute.

And if the last few years are any indicator, it knows how.

Note: This article relies on data from annual and industry reports. We have used our assumptions for forecasting.

Parth Parikh has over a decade of experience in finance and research and currently heads the growth and content vertical at Finsire. He has a keen interest in Indian and global stocks and holds an FRM Charter along with an MBA in Finance from Narsee Monjee Institute of Management Studies. Previously, he held research positions at various companies.

Disclosure: The writer and his dependents do not hold the stocks discussed in this article.

The website managers, its employee(s), and contributors/writers/authors of articles have or may have an outstanding buy or sell position or holding in the securities, options on securities or other related investments of issuers and/or companies discussed therein. The content of the articles and the interpretation of data are solely the personal views of the contributors/ writers/authors. Investors must make their own investment decisions based on their specific objectives, resources and only after consulting such independent advisors as may be necessary.

Must Read

Buzzing Now

May 04: Latest News

- 01

- 02

- 03

- 04

- 05