Silver47 Exploration Corp. (TSXV: AGA) (FSE: QP2) ("Silver47" or the "Company") is pleased to announce closing of the first tranche (the "First Tranche") of its previously announced non-brokered private placement (the "Offering") in the Company's news releases of February 19 and 24, 2025. Pursuant to the closing of the First Tranche, the Company issued (i) 6,912,400 units of the Company (the "Units") at a price of $0.50 each; and (ii) 929,192 flow-through units of the Company (the "FT Units") at a price of $0.57 each, for aggregate gross proceeds to the Company of $3,985,839. In addition, the balance of the Offering is expected to occur on or about March 12, 2025 or as may be determined by the Company.

- WORLD EDITIONAustraliaNorth AmericaWorld

Investing News NetworkYour trusted source for investing success

- Lithium Outlook

- Oil and Gas Outlook

- Gold Outlook Report

- Uranium Outlook

- Rare Earths Outlook

- All Outlook Reports

- Top Generative AI Stocks

- Top EV Stocks

- Biggest AI Companies

- Biggest Blockchain Stocks

- Biggest Cryptocurrency-mining Stocks

- Biggest Cybersecurity Companies

- Biggest Robotics Companies

- Biggest Social Media Companies

- Biggest Technology ETFs

- Artificial Intellgience ETFs

- Robotics ETFs

- Canadian Cryptocurrency ETFs

- Artificial Intelligence Outlook

- EV Outlook

- Cleantech Outlook

- Crypto Outlook

- Tech Outlook

- All Market Outlook Reports

- Cannabis Weekly Round-Up

- Top Alzheimer's Treatment Stocks

- Top Biotech Stocks

- Top Plant-based Food Stocks

- Biggest Cannabis Stocks

- Biggest Pharma Stocks

- Longevity Stocks to Watch

- Psychedelics Stocks to Watch

- Top Cobalt Stocks

- Small Biotech ETFs to Watch

- Top Life Science ETFs

- Biggest Pharmaceutical ETFs

- Life Science Outlook

- Biotech Outlook

- Cannabis Outlook

- Pharma Outlook

- Psychedelics Outlook

- All Market Outlook Reports

CuFe Limited Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

CuFe Limited

Overview

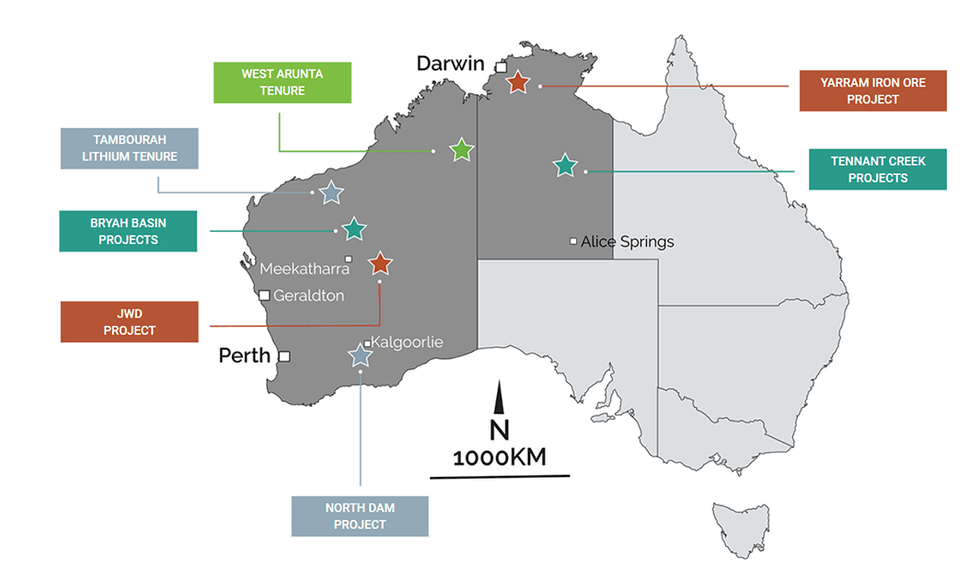

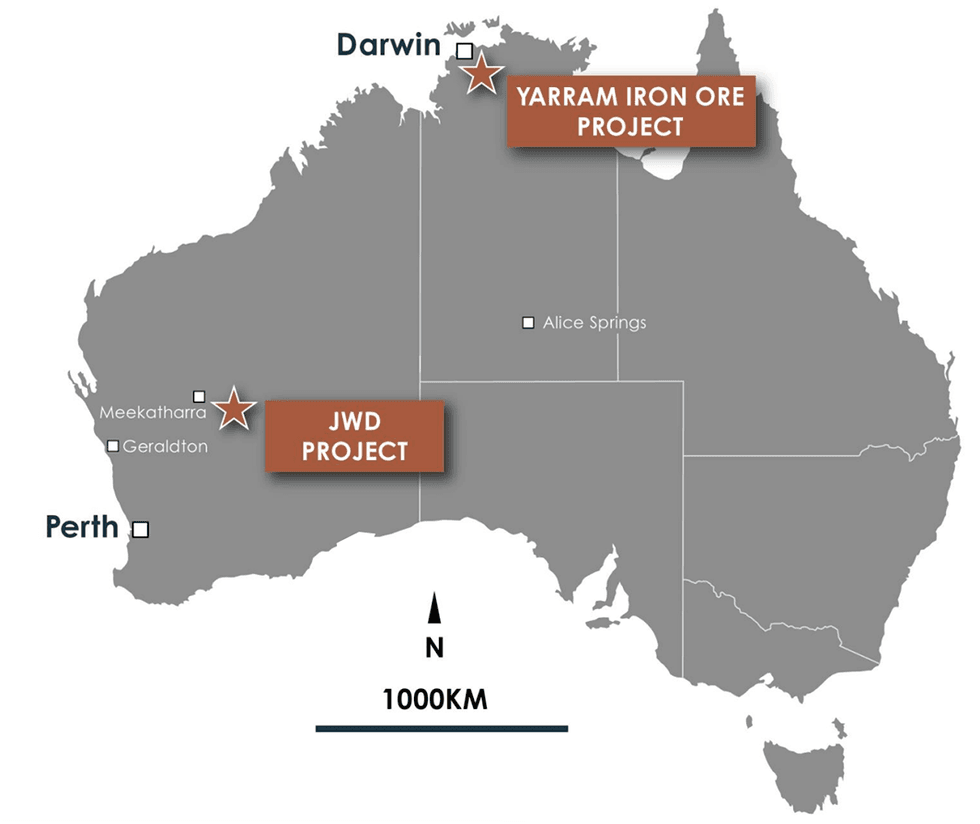

CuFe Limited (ASX:CUF) is a multi-commodity exploration and development company with interest in eight projects situated throughout mature mining jurisdictions in Western Australia and the Northern Territory. The company's value proposition is predicated on its high-grade premium product iron ore projects as well as its exposure to copper, lithium and niobium. Its exploration portfolio includes mature copper targets at Tennant Creek, drill-ready lithium targets at North Dam, and greenfield exploration ground in close proximity to WA1's recent niobium discovery.

Tennant Creek hosts a mineral resource estimate of 7.3 million tons (Mt) at 1.7 percent copper and 0.6 grams per ton (g/t) gold for 127 kt copper and 145 koz gold. CuFe currently owns a 55 percent interest over 240 kilometres of the highly-prospective tenure, situated in the Northern Territory. CuFe's near-term plan for the mine, based on detailed mine planning, involves a staged cutback of the Orlando open pit to gain access to an ore supply for fast start options.

CuFe is also evaluating the Yarram project, as its close proximity to the Darwin port gives it the potential for low opex.

Lastly, CuFe has a low-risk 2 percent NSR gold royalty over the Northern Star Crossroads project, where mining is expected to commence in 2024.

CuFe is led by a highly experienced management team adept at identifying opportunities, making discoveries, evaluating and developing projects and maintaining operations. The team is led by executive director Mark Hancock, who has 25 years experience in resource projects across a variety of commodities in senior finance, commercial and marketing roles.

Company Highlights

- CuFe Limited is an ASX-listed iron, copper, lithium and niobium exploration and development company with a multi-commodity portfolio of assets.

- The company's assets are situated in mature mining regions in Western Australia and the Northern Territory, with access to extensive pre-existing infrastructure.

- CuFe's projects are highly prospective in copper (Tennant Creek, Bryah Basin), lithium (North Dam, Tambourah) and niobium (West Arunta).

- Additionally, the company has a 50 percent interest in the Yarram project, an advanced iron ore development project with potential for low-cost production.

- CuFe also has a 2 percent net smelter royalty over the Crossroads gold project in Kalgoorlie.

- The company is led by a proven and experienced in-house team with expertise in identification, discovery, evaluation, deployment and operations.

Key Projects

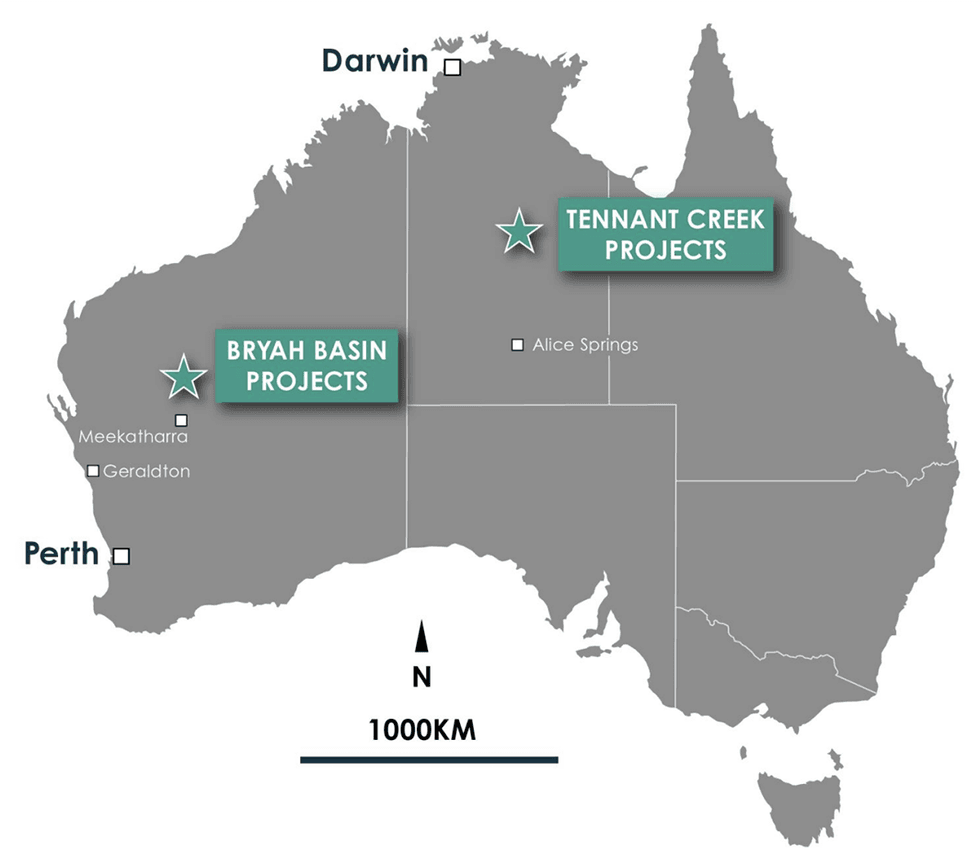

Copper

Tennant Creek

The Tennant Creek project is located in the highly prospective Gecko-Goanna copper-gold corridor of the Northern Territory. A mature project comprising three high-grade copper and gold mineral resources, it contains a combined JORC 2012 mineral resource of 7.3 at 1.7 percent copper and 0.6 g/t gold for 127 kt copper and 145 koz gold. Highly-prospective for further resource growth from resource extensions and new discoveries, Tennant Creek is also located in close proximity to grid power, a gas pipeline, the Stuart highway and the rail line to Darwin.

The area where Tennant Creek is hosted is a re-emerging mineral field with recent neighbouring exploration success from companies such as Emmerson Resources (ASX:ERM) and Tennant Minerals (ASX:TMS). Near-mine targets include the potential to extend resources and open enrichment within the Orlando and Gecko structural corridors.

The current focus for Tennant Creek is to identify and drill high-potential exploration targets with a view to growing the resource base while considering a staged cutback of the existing Orlando open pit to gain access to an ore supply for a fast start option.

Bryah Basin JV projects

Through wholly owned subsidiary Jackson Minerals, CuFe has a 20 percent interest in roughly 804 square kilometres of highly-prospective tenements proximal to the former Sandfire Resources' (ASX:SFR) Doolgunna project and Degrussa copper gold mine, as well as several other prominent gold and copper prospects. Collectively known as the Bryah Basin JV projects, the tenements are currently subject to joint ventures and farm-ins with several companies. The most prominent of these is the Morck Well project, which is under an exploration licence with Auris Minerals (ASX:AUR) alongside the Forrest project.

The Morck Well project tenements cover an area of 600 square kilometres in the highly-prospective region, which has been recognized to have high iron ore potential.

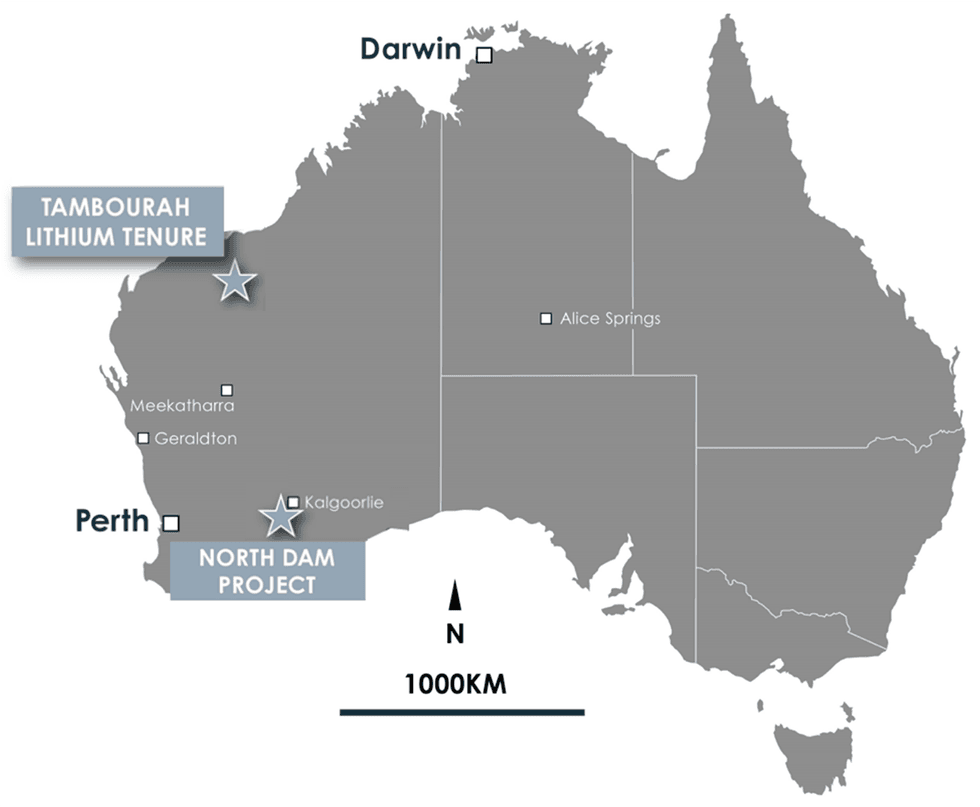

Lithium

North Dam

The North Dam project is a highly prospective lithium tenure situated in the emerging Yilgarn Lithium Belt. Located roughly 50 kilometres south-southeast of the township of Coolgardie, the project is contained within the same lithium belt that contains known spodumene deposits such as Mt Marion, Pioneer Dome, Bald Hill, Manna and Buldania. There have also been several well-known junior exploration successes immediately adjacent to the tenement, including Kali Metals (ASX:KM1), Marquee Resources (ASX:MQR) and Maximum Resources.

To date, work on the project has included defining prospective pegmatites through rock chip sampling, soil sampling and geological mapping. Anomalous lithium and key pathfinder elements have also defined a prospective corridor of roughly 3.5 kilometres in strike length. Columbite and tantalite rock chips selected from a stream bed also contain up to 44 percent niobium and 14.53 percent tantalum.

CuFe has also completed a recent heritage survey and, pending results and conditions, plans to commence a maiden drill program.

Tambourah

The 100 percent owned Tambourah Tenure is a prospective lithium tenure with known gold occurrences. Located roughly 90 kilometres south of the Pilgangoora and Wodgina lithium complexes, and 175 kilometres south of Port Hedland, the project was historically explored for gold and contains known gold occurrences within alluvial material and reef systems. Current work on the project to date has involved geological mapping and rock chip sampling.

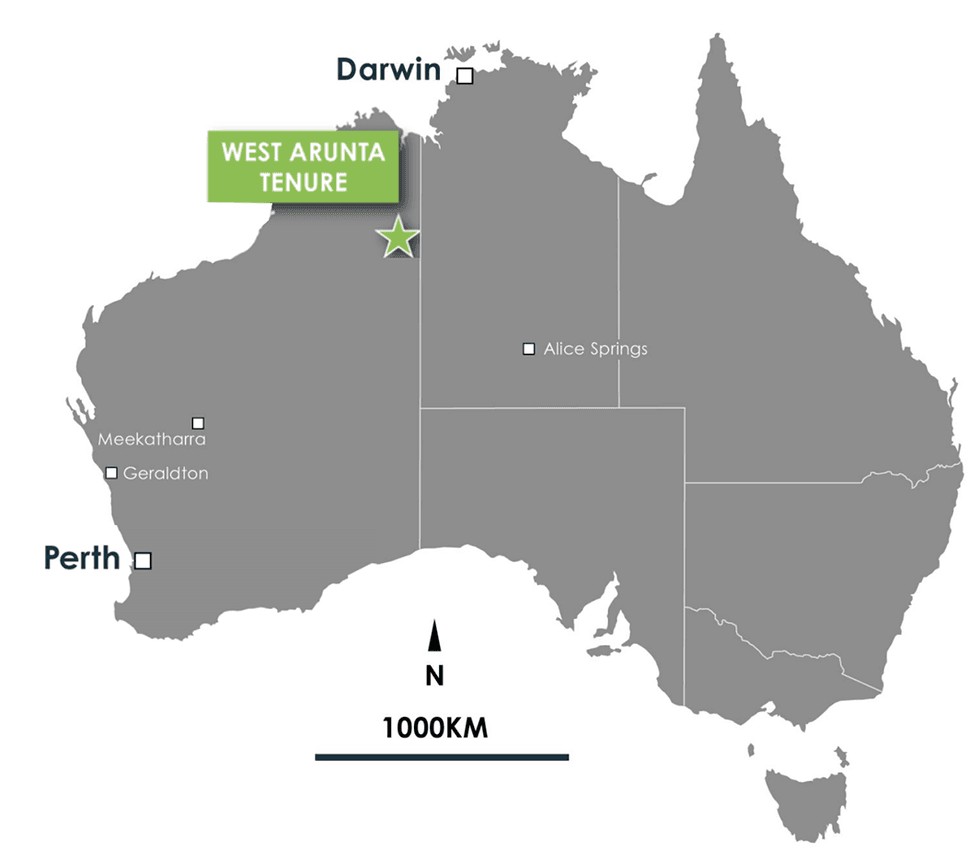

Niobium

West Arunta

The fully owned West Arunta consists of three tenements located in the highly-prospective region of the same name. The tenure is known to be prospective for carbonatite-hosted niobium and rare earth element mineralization. Spanning roughly 220 square kilometres, it surrounds Lycaon Resources' (ASX:LYN) Stansmore project and is located 70 kilometres north of several prominent recent discoveries.

CuFe has not yet finalised native title arrangements to commence work in the ground so in the meantime it engaged Southern Geoscience Consulting to undertake a geophysical review of publicly available airborne magnetic data for the tenements including re-processing of said data and 3D unconstrained inversion modeling. Analysis of the total magnetic imagery revealed three anomalous areas across the package, resulting in nine target anomalies for further investigation and exploration.

Iron

Yarram

The Yarram iron ore project is a mature development opportunity with the potential for low-cost production. CuFe currently holds a 50 percent interest in the project, which includes operatorship. Partially located on an existing mining lease on freehold land, Yarram has a high-grade DSO resource of 5.6 MT at +60 percent iron as well as a low-grade component of 7.1 Mt with the potential for beneficiation.

Situated 110 kilometres from Darwin Port and adjacent to underutilised mining infrastructure, Yarram also features favourable ore body geometry, with existing infrastructure and services contributing to its low capex and opex.

An initial diamond drilling program provided HG core from two deposits within the project. Physical and thermal metallurgical testing confirms the generation of a lump product with roughly 41 percent yield, elevated gangue levels in the very fine fractions and acceptable thermal and materials handling properties, making it suitable as a blast furnace lump burden feed.

CuFe has also undertaken geotechnical testwork on the diamond drill core to provide parameters for pit optimizations and designs. Final pit shells and a high-level mine schedule have been developed for use in regulatory approvals.

Gold Royalty

Crossroad gold project

Through fully owned subsidiary Jackson Minerals, CuFe holds a 2 percent net smelter royalty over M24/462, which contains Northern Star's (ASX:NST) Crossroads gold project. This project is the subject of a recently approved mining proposal envisaging the mining of 2.67 Mt of gold-bearing ore. The project is expected to commence sometime in 2024 and run for a 36-month period, with the majority of ore mined in the second and third years after pre-stripping.

This project represents a potential near-term revenue source for CuFe with no associated costs.

Management Team

Tony Sage — Executive Chairman (BCom, FCPA, CA, FTIA )

Tony Sage is an entrepreneur with over 36 years of experience in corporate advisory services, funds management and capital raising, predominantly within the resource sector. He is based in Western Australia and has continued to be involved in managing and financing listed mining and exploration companies with a diverse commodity base.

Sage has developed global operational experience within Europe, North and South America, Africa, Oceania, Asia and the Middle East. He is currently executive chairman of ASX-listed Cyclone Metals Limited (ASX:CLE) and European Lithium (ASX:EUR).

Mark Hancock — Executive Director

Mark Hancock has over 30 years’ experience in key financial, commercial and marketing roles across a variety of industries with a strong focus on natural resources. During his 13 years at Atlas Iron Ltd, Hancock served in numerous roles including CCO, CFO, Executive Director and Company Secretary. He has also served as a director on a number of ASX listed entities and is currently a director of Centaurus Metals Ltd and Strandline Resources Ltd.

Hancock holds a Bachelor of Business (B.Bus) degree, is a Chartered Accountant (CA) and is a Fellow of the Financial Services Institute of Australia (F FIN).

David Palmer - Non-executive Director

David Palmer is a geologist and company director with more than 38 years’ experience in the global exploration industry, the majority of his career has been with Rio Tinto Exploration focused on copper/gold, base metals, industrial minerals, uranium, iron ore, and diamonds throughout Australia and the Asia/Pacific. Palmer is a member of AusIMM and the AICD. Amongst other senior positions, Palmer led the business development, mineral title and indigenous engagement functions and was part of the management team that discovered the world-class Winu Cu-Au deposit. He holds a Bachelor of Science (First Class Honours) from the University of Newcastle.

Scott Meacock — Non-executive Director

Scott Meacock has a wealth of experience as external counsel acting in, and advising on, complex corporate and commercial law transactions and disputes for clients in a wide range of industry sectors including natural resources and financial services.

Meacock currently serves as the Chief Executive Officer and General Counsel of the Gold Valley Group. He holds a Bachelor of Laws (LLB) degree and a Bachelor of Commerce (BComm) degree from the University of Western Australia.

Matthew Ramsden – GM Development

Matthew Ramsden is an experienced geologist and project developer commencing his career in Tasmania before stints in the Pilbara with Rio Tinto and Atlas Iron, where he played a key role in the development and ramp-up of six iron ore mines.

He joined CuFe in 2021 to commence the JWD operations and now has oversight over the company’s exploration and development projects.

Ramsden is a member of the Australasian Institute of Geoscientists.

Siobhán Sweeney — Geology Manager

Siobhán Sweeney brings over 13 years’ geology experience to the CuFe team, from greenfield’s exploration to resource development with a strong focus on target generation and development of iron ore projects. During her 8 years at Atlas Iron Ltd, Sweeney was instrumental in developing critical iron ore projects in the Pilbara such as Miralga Creek and Corunna Downs. Her background in managing complex and challenging exploration programs has been key to delivering successful projects.

Since joining Cufe in July 2021, Sweeney has been tasked with developing and implementing mine geology processes during the start-up phase of the JWD mine. Most recently she has delivered a successful exploration drill campaign to further define the Yarram iron ore deposit.

Sweeney is a member of the Australian Institute of Geoscientists and holds a Bachelor of Science degree (hons) in geology from the National University of Ireland Galway.

Visible Gold Above High Grade Cu-Au Porphyry - Amended

Silver47 Closes First Tranche of Non-brokered Private Placement

Each Unit consists of one common share in the capital of the Company (a "Common Share") and one-half of one Common Share purchase warrant (a "Half-Warrant", with two Half-Warrants being referred to as a "Warrant"). Each Warrant entitles the holder thereof to acquire one Common Share at a price of $0.75 within 36 months following issuance. Each FT Unit consists of one Common Share and a Half-Warrant (subject to the same terms as indicated above), each issued as a "flow-through share" pursuant to the Income Tax Act (Canada).

The Company intends to use the net proceeds from the sale of the Units to fund exploration activities at the Red Mountain Project in Alaska and for general working capital and to use the gross proceeds from the sale of FT Units for exploration expenditures at the Company's Adams Plateau Project.

The proceeds from the sale of the FT Units will be used to incur eligible "Canadian exploration expenses" that qualify as "flow-through mining expenditures" as both terms are defined in the Income Tax Act (Canada), and for British Columbia subscribers, "BC flow-through mining expenditures" as defined in the Income Tax Act (British Columbia), (the "Qualifying Expenditures") on the Company's Adams Plateau Project in British Columbia, with such expenses to be incurred on or before December 31, 2026, and the Company will renounce all the Qualifying Expenditures in favour of the subscribers of the FT Units effective December 31, 2025.

In connection with the First Tranche, the Company has paid certain persons ("Finders") finders' fees totaling $199,699, representing 7% of the aggregate proceeds raised by the Finders, and issued 398,888 finders' warrants (the "Finder's Warrants"), representing 7% of the number of securities sold to subscribers introduced to the Company by the Finders. Each Finder's Warrant is exercisable for one Common Share at an exercise price of $0.75 for a period of 36 months from the date of issuance.

All securities issued under the Offering are subject to a hold period of four months and one day from the date of issuance under applicable securities laws. The Offering is subject to the final approval of the TSX Venture Exchange (the "TSXV").

Certain directors and officers of the Company acquired an aggregate of 720,000 Units under the First Tranche. The issuance of securities to such insiders is considered a "related party transaction" as defined under Multilateral Instrument 61-101 - Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Company is relying on exemptions from the formal valuation and minority shareholder approval requirements of MI 61-101 as the Company is listed on the TSXV and neither the fair market value of securities issued to related parties nor the consideration being paid by related parties will exceed 25% of the Company's market capitalization.

This news release does not constitute an offer to sell or a solicitation of an offer to buy nor shall there be any sale of any securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful. The securities have not been and will not be registered under the United States Securities Act of 1933, as amended (the "1933 Act"), or any state securities laws and may not be offered or sold in the "United States" or to "U.S. persons" (as such terms are defined in Regulation S under the 1933 Act) unless registered under the 1933 Act and applicable state securities laws, or an exemption from such registration requirements is available.

About Silver47 Exploration Corp.

Silver47 wholly-owns three silver and critical metals (polymetallic) exploration projects in Canada and the US: the Flagship Red Mountain silver-gold-zinc-copper-lead-animonty-gallium VMS-SEDEX project in southcentral Alaska; the Adams Plateau silver-zinc-copper-gold-lead SEDEX-VMS project in southern British Columbia, and the Michelle silver-lead-zinc-gallium-antimony MVT-SEDEX Project in Yukon Territory. Silver47 Exploration Corp. shares trade on the TSXV under the ticker symbol AGA. For more information about Silver47, please visit our website at www.silver47.ca.

On Behalf of the Board of Directors

Mr. Gary R. Thompson

Director and CEO

gthompson@silver47.ca

For investor relations

Meredith Eades

info@silver47.ca

778.835.2547

No securities regulatory authority has either approved or disapproved of the contents of this release. Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS

This release contains certain "forward looking statements" and certain "forward-looking information" as defined under applicable Canadian securities laws. Forward-looking statements and information can generally be identified by the use of forward-looking terminology such as "may", "will", "expect", "intend", "estimate", "upon" "anticipate", "believe", "continue", "plans" or similar terminology. Forward-looking statements and information include, but are not limited to: closing of the Offering, including the number of Units and FT Units issued in respect thereof; anticipated use of proceeds; expected closing date of the Offering; payment of finder's fees; ability to obtain all necessary regulatory approvals; insider participation in the Offering; the statements in regards to existing and future products of the Company; and the Company's plans and strategies. Forward-looking statements and information are based on forecasts of future results, estimates of amounts not yet determinable and assumptions that, while believed by management to be reasonable, are inherently subject to significant business, economic and competitive uncertainties and contingencies. Forward-looking statements and information are subject to various known and unknown risks and uncertainties, many of which are beyond the ability of the Company to control or predict, that may cause the Company's actual results, performance or achievements to be materially different from those expressed or implied thereby, and are developed based on assumptions about such risks, uncertainties and other factors set out herein, including but not limited to: the ability to close the Offering, including the time and sizing thereof, the insider participation in the Offering and receipt of required regulatory approvals; the use of proceeds not being as anticipated; the Company's ability to implement its business strategies; risks associated with general economic conditions; adverse industry events; stakeholder engagement; marketing and transportation costs; loss of markets; volatility of commodity prices; inability to access sufficient capital from internal and external sources, and/or inability to access sufficient capital on favourable terms; industry and government regulation; changes in legislation, income tax and regulatory matters; competition; currency and interest rate fluctuations; and the additional risks identified in the Company's financial statements and the accompanying management's discussion and analysis and other public disclosures recently filed under its issuer profile on SEDAR+ and other reports and filings with the TSXV and applicable Canadian securities regulators. The forward-looking information are made based on management's beliefs, estimates and opinions on the date that statements are made and the Company undertakes no obligation to update forward-looking statements if these beliefs, estimates and opinions or other circumstances should change, except as required by applicable securities laws.

No forward-looking statement can be guaranteed, and actual future results may vary materially. Accordingly, readers are advised not to place undue reliance on forward-looking statements.

NOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISTRIBUTION OR DISSEMINATION IN OR INTO THE U.S.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/243504

News Provided by Newsfile via QuoteMedia

Visible Gold Discovered Above High Grade Cu-Au Porphyry

Update on the Renounceable Rights Issue to raise $5.2M

Nuvau Minerals' 2023 Sonic Drilling Program Yields Regionally Significant Anomaly

More than 2,000 gold grains per 10kg of material

Nuvau Minerals Inc. (TSXV: NMC) (the "Company" or "Nuvau"), is pleased to share a highlight from its fall 2023 sonic drilling program at the Matagami Mining Camp that has delineated an exciting new gold target on the Company's large-scale property.

- Hole PD-23-030s delivered a gold grain anomaly with more than 2,000 gold grains per 10 kg of material, supported by a near-contiguous sample with 295 gold grains

"This anomaly is of prime significance as potential evidence of an eroded gold occurrence, likely located within a kilometre north-east of the hole collar," said Peter van Alphen, President and CEO. "The Matagami camp has a long history of base metal mining, and yet the property's location in the Abitibi also makes it a prime location for gold mineralisation. At over 2,000 grains of gold per 10kg of material, this is an anomaly of regional significance, likely higher than any previous results known in the Abitibi. The Borden Gold Mine in Chapleau was discovered through the same means of mapping overburden till anomalies, and the highest concentration seen in that case was only about 800 grains per 10kg."

About the 2023 Sonic Drill Program at the Matagami Property

Following a successful proof-of-concept survey conducted in spring 2023, a first phase of a property scale overburden drilling program was conducted on the Matagami property, approximately 30 kilometres to the west of the Matagami Mill complex, in late 2023. The sonic drill program consisted of 24 holes totaling 726 metres of core and was conducted to evaluate the potential dispersion of gold and base metal minerals in glacial sediments buried underneath the Ojibway clay belt. Part of the survey was aimed at confirming a gold-in-till anomaly first detected by Newmont Mining in 1987.

The Matagami Property is located in a part of the northern Abitibi greenstone belt that is host to numerous gold and base metal mines, however, very little effort was previously focused on the gold potential of this large property. Canada's largest producing gold mine, Agnico's Detour Mine, is located on-trend to the west (see figure 2). The Casa Berardi Mine is located to the southwest of the Matagami Property and was discovered through a combination of geological exploration techniques, including prospecting based on regional geological mapping, airborne geophysical surveys, and subsequent ground-based exploration including soil and till sampling.

A total of 151 samples of glacial sediments were collected and submitted for gold grains and indicator mineral counting with the use of automated ARTGold technology by IOS Geosciences from Saguenay, QC, plus multi-element chemical analysis of the fine fraction (-170 um) of the sediments. A total of 9 samples are deemed anomalous, with gold grain counts in excess of 30 grains per 10kg of material.

Hole PD-23-030s - Of these, one sample from hole PD-23-030s produced a notable gold grain anomaly. The anomaly was detected at depth between 29.26 to 29.87 metres in the overburden (sample 155320186), and featured more than 2,000 gold grains per 10 kg of material. In addition, a near-contiguous sample with 295 gold grains per 10 kg of material between 31.12 to 32.00 metres (sample 155320187) was also encountered. The interval between these two samples consisted of a large locally derived boulder.

The bulk of these gold grains bear very delicate (pristine) form, with enshrined silicate minerals, suggestive of minimal glacial transport. No chemical anomalies and no abnormal abundance of indicator minerals were detected.

Pebbles in these samples consist uniquely of andesitic basalts, along with a significant proportion of quartz veins fragments. This suggests the presence of an auriferous quartz vein system invading the meta-andesite, believed to possibly be within a kilometre to the north-east of the collar.

This anomaly is located approximately 5 metres above the bedrock, meaning it has been displaced by glacial movement. Since no previous drilling or outcrop is available in the north-east up-ice direction, displacement cannot be accurately estimated.

Additional analysis is still required to understand the follow-up action required, however; a second-order structure highlighted by a VTEM geophysical anomaly beside a high-gravity distinct anomaly is present 2 kilometres in this direction, which is tentatively suggested as potential source and is currently considered as a priority diamond drill target.

Figure 1 : Nuvau's Matagami property, General Location

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11236/243224_nuvauimg1.jpg

Figure 2: Matagami Property Location relative to the gold producers of the region. Results from adjacent property(ies) are not necessarily indicative of the mineralization on Nuvau's property.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11236/243224_a80e63aa64427b4c_004full.jpg

Figure 3: Location of hole PD-23-030s with airborne gravity map (color) and VTEM pick (black dots)

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11236/243224_a80e63aa64427b4c_005full.jpg

Figure 4: Mosaic of backscattered electron images of gold grain. Notice the delicate textures and silicate attachments. LEFT: Image of 230 gold grains found in sample 155320186, hole PD-23-030s, RIGHT: Image of 112 gold grains found in adjacent sample 155320187.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11236/243224_nuvauimg4.jpg

Figure 5: (Left) Pebble composition of sample 155320186 showing 2,000 grains of gold per 10kg, and (right) section of Hole PD-23-030s indicating samples 155320186 and 155320187 (shown as 20186 and 20187 for brevity).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11236/243224_a80e63aa64427b4c_012full.jpg

About Nuvau Minerals Inc.

Nuvau is a Canadian mining company focused on the Abitibi Region of mine-friendly Québec. Nuvau's principal asset is the Matagami Property that is host to significant existing processing infrastructure and multiple mineral deposits and is being acquired from Glencore.

Qualified Person and Quality Assurance

Gilles Roy, P. Geo. (Qc), Director of Exploration of Nuvau and a "qualified person" as is defined by National Instrument 43-101, has verified the scientific and technical data disclosed in this news release, and has otherwise reviewed and approved the scientific and technical information in this news release.

Core has been quicklogged on drilling site and shipped by truck to IOS facilities in Saguenay for detailed logging and sampling by a qualitifed quartenary geologist. Hole core from selected intervals has been bagged and queued for processing in the same facility, where samples were sifted and gold grain concentrated with a proprietary fluidized bed. Concentrates were then dry sifted at 50 μm, the +50 μm being examined under optical microscope while -50 μm being scanned by automated electron microscope. Every suspected gold grain has been analysed by Energy Dispersive X-Ray Spectrometer (EDS) and high magnification back-scattered images have been acquired in order to classify morphology. Quality control is ensured via various mass balance calculations and EDS analysis of all grains of interest, prior to results being cross-examined by experienced geologists. In the course of sifting, an aliquot of the sample has been saved and shipped for analysis to Activation Laboratories in Ancaster, Ontario, for ICP-MS-QQQ ultra-trace analyses after aqua-regia digestion. Quality control has been conducted by a certified chemist and includes approximately 15% blanks, certified reference materials and internal reference materials.

Cautionary Statements

This news release contains forward-looking statements and forward-looking information (collectively, "forward-looking statements") within the meaning of applicable securities laws. Any statements that are contained in this news release that are not statements of historical fact may be deemed to be forward-looking statements. Forward-Looking statements are often identified by terms such as "may", "should", "anticipate", "will", "estimates", "believes", "intends" "expects" and similar expressions which are intended to identify forward-looking statements. More particularly and without limitation, this news release contains forward-looking statements concerning drill results relating to the Matagami Property, the results of the PEA, the potential of the Matagami Property, the timing and commencement of any production, the restart of the Bracemac-McLeod Mine, the completion of the earn-in of the Matagami Property and the timing and completion of any technical studies, feasibility studies or economic analyses. Forward-Looking statements are inherently uncertain, and the actual performance may be affected by a number of material factors, assumptions and expectations, many of which are beyond the control of the Company, including expectations and assumptions concerning the Company and the Matagami Property. Readers are cautioned that assumptions used in the preparation of any forward-looking statements may prove to be incorrect. Events or circumstances may cause actual results to differ materially from those predicted as a result of numerous known and unknown risks, uncertainties, and other factors, many of which are beyond the control of the Company. Readers are further cautioned not to place undue reliance on any forward-looking statements, as such information, although considered reasonable by the management of the Company at the time of preparation, may prove to be incorrect and actual results may differ materially from those anticipated.

The forward-looking statements contained in this news release are made as of the date of this news release, and are expressly qualified by the foregoing cautionary statement. Except as expressly required by securities law, neither the Company nor Nuvau undertakes any obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events or otherwise.

For further information please contact:

Nuvau Minerals Inc.

Peter van Alphen

President and CEO

Telephone: 416-525-6023

Email: pvanalphen@nuvauminerals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release. No stock exchange, securities commission or other regulatory authority has approved or disapproved the information contained herein.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/243224

News Provided by Newsfile via QuoteMedia

StrategX Discovers Extensive High-Grade Graphite at Nagvaak and Expands Mineral Claims to 79,781 Hectares on the Melville Peninsula, Nunavut, Canada

StrategX Elements Corp. (CSE: STGX) ("StrategX" or the "Company") is pleased to announce the discovery of a wide zone of high-grade graphite mineralization at its Nagvaak property on the Melville Peninsula, Nunavut. A 32-metre drill core interval from historical drill hole NAG96-17 returned an average grade of 15% graphitic carbon (Cg), with a 17-metre section grading 22% Cg. These results reinforce the potential for a significant graphite deposit within the emerging Melville Critical Metals Belt.

Building on this success, StrategX has expanded its mineral claim property position to 79,781 hectares, securing control over a highly prospective critical minerals district. The Company is advancing exploration efforts in the region, positioning itself at the forefront of critical mineral discoveries in Canada.

Key Highlights:

- Significant Graphite Discovery: Assay results from NAG96-17 confirm high-grade graphite, with 19 samples exceeding 20% Cg, including a peak grade of 34.9% Cg. Thin section analysis reveals large (>500 micron) crystalline graphite aggregates, indicating potential for high-quality flake graphite.

- Polymetallic Potential: The same drill hole also returned encouraging concentrations of nickel, copper, zinc, molybdenum, vanadium pentoxide, and silver, further supporting the potential for a multi-metal mineral system (See Table 1).

- Regional Scale Opportunity: The Melville Critical Metals Belt, spanning 200 km by 100 km, contains multiple geophysical anomalies, suggesting an untapped and district-scale mineral system in the same sedimentary belt.

- Exploration Advancement: StrategX has established a base camp and positioned a drill rig at Nagvaak, setting the stage for its 2025 drilling campaign to further define high-grade graphite zones and explore additional targets.

High-Grade Graphite Discovery at Nagvaak

Following encouraging initial results from 20 core samples previously reported here, the Company analyzed the remaining core from NAG96-17, totaling 56 samples. The results confirmed a 32-metre interval averaging 15% Cg from 14.4 m to 47.0 m, with multiple high-grade intercepts including 23% Cg from 58.8 m to 62.8 m, reinforcing the potential for large-scale graphite mineralization.

Given that graphitic schist units have been mapped along a 6 km corridor at Nagvaak-and similar units have been documented throughout the Melville Critical Metals Belt by the Geological Survey of Canada-this discovery signals significant regional potential for additional wide zones of high-grade graphite (Figure 1).

Figure 1: StrategX's property position & regional potential - Melville Critical Metals Belt

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8512/243029_05765eb8d49b29c2_006full.jpg

| Table 1 - NAG96-17 Assay results * Indicates newly analyzed values. All other values have been previously released. | ||||||||||

| Sample # | From | To | C Graphitic | Mo | Zn | Ag | Ni | Cu | Au + PGE | V2O5 |

| % | % | % | g/t | % | % | g/t | % | |||

| NC-245* | 2.4 | 3.4 | 28.00 | 0.04 | 0.10 | 9.12 | 0.13 | 0.19 | 0.25 | 0.34 |

| NC-246* | 3.4 | 4.4 | 28.20 | 0.04 | 0.28 | 6.79 | 0.17 | 0.09 | 0.05 | 0.33 |

| NC-247* | 4.4 | 5.4 | 8.89 | 0.04 | 0.09 | 9.68 | 0.14 | 0.15 | 0.07 | 0.53 |

| NC-248* | 5.4 | 6.4 | 7.01 | 0.04 | 0.03 | 9.66 | 0.13 | 0.16 | 0.06 | 0.55 |

| NC-249* | 6.4 | 7.4 | 12.60 | 0.03 | 0.06 | 6.46 | 0.27 | 0.16 | 0.21 | 0.41 |

| NC-249B* | 7.4 | 8.4 | 2.03 | 0.04 | 0.08 | 14.20 | 0.20 | 0.29 | 0.07 | 0.44 |

| NC-250* | 8.4 | 9.4 | 0.10 | 0.01 | 0.14 | 8.28 | 0.26 | 0.15 | 0.10 | 0.32 |

| NC-251* | 9.4 | 10.4 | 0.09 | 0.01 | 0.13 | 4.38 | 0.15 | 0.07 | 0.13 | 0.14 |

| NC-252* | 10.4 | 11.4 | 0.02 | 0.00 | 0.02 | 10.60 | 0.21 | 0.19 | 0.10 | 0.21 |

| NC-253* | 11.4 | 12.4 | 0.06 | 0.03 | 0.03 | 5.32 | 0.10 | 0.10 | 0.05 | 0.27 |

| NC-254* | 12.4 | 13.4 | 0.05 | 0.02 | 0.02 | 1.90 | 0.03 | 0.02 | 0.02 | 0.18 |

| NC-255* | 13.4 | 14.4 | 0.12 | 0.00 | 0.06 | 2.86 | 0.06 | 0.04 | 0.04 | 0.18 |

| NC-256* | 14.4 | 15.4 | 2.51 | 0.03 | 0.05 | 3.62 | 0.08 | 0.06 | 0.03 | 0.29 |

| NC-257 | 15.4 | 16.4 | 11.85 | 0.05 | 0.04 | 4.92 | 0.14 | 0.11 | 0.05 | 0.26 |

| NC-258 | 16.4 | 17.4 | 10.15 | 0.02 | 0.08 | 5.23 | 0.39 | 0.10 | 0.05 | 0.29 |

| NC-259 | 17.4 | 18.4 | 31.00 | 0.04 | 0.64 | 8.28 | 0.21 | 0.11 | 0.05 | 0.42 |

| NC-260 | 18.4 | 19.4 | 14.95 | 0.03 | 0.61 | 7.97 | 0.29 | 0.14 | 0.19 | 0.47 |

| NC-261 | 19.4 | 20.4 | 23.90 | 0.04 | 3.55 | 6.33 | 0.25 | 0.12 | 0.07 | 0.30 |

| NC-262 | 20.4 | 21.4 | 25.30 | 0.04 | 0.64 | 7.20 | 0.12 | 0.10 | 0.06 | 0.42 |

| NC-263 | 21.4 | 22.4 | 20.10 | 0.03 | 0.30 | 7.46 | 0.30 | 0.08 | 0.07 | 0.41 |

| NC-264 | 22.4 | 23.4 | 23.60 | 0.04 | 0.87 | 7.30 | 0.19 | 0.08 | 0.07 | 0.35 |

| NC-265 | 23.4 | 24.4 | 25.20 | 0.02 | 2.42 | 9.51 | 0.21 | 0.16 | 0.18 | 0.36 |

| NC-266* | 24.4 | 25.4 | 26.90 | 0.03 | 0.60 | 7.59 | 0.19 | 0.07 | 0.07 | 0.34 |

| NC-267* | 25.4 | 26.4 | 22.90 | 0.03 | 0.07 | 10.80 | 0.11 | 0.23 | 0.03 | 0.41 |

| NC-268* | 26.4 | 27.4 | 23.00 | 0.02 | 0.80 | 6.98 | 0.24 | 0.13 | 0.10 | 0.41 |

| NC-269* | 27.4 | 28.4 | 25.50 | 0.03 | 0.02 | 9.45 | 0.24 | 0.19 | 0.11 | 0.33 |

| NC-270 | 28.4 | 29.4 | na | 0.04 | 0.08 | 12.90 | 0.24 | 0.31 | 0.11 | 0.38 |

| NC-271 | 29.4 | 30.4 | 22.80 | 0.04 | 0.13 | 8.75 | 0.33 | 0.18 | 0.14 | 0.43 |

| NC-272 | 31.4 | 32.4 | 18.10 | 0.05 | 0.09 | 6.80 | 0.24 | 0.12 | 0.11 | 0.48 |

| NC-273 | 32.4 | 33.4 | 15.05 | 0.05 | 0.17 | 7.52 | 0.19 | 0.14 | 0.07 | 0.50 |

| NC-274 | 33.4 | 34.4 | 25.30 | 0.04 | 1.11 | 12.10 | 0.24 | 0.23 | 0.14 | 0.44 |

| NC-275 | 34.4 | 35.1 | 29.60 | 0.04 | 1.01 | 10.15 | 0.26 | 0.08 | 0.09 | 0.44 |

| NO SAMPLE | 35.1 | 36.0 | na | na | na | na | na | na | na | na |

| NC-276 | 36.0 | 37.0 | 34.90 | 0.04 | 0.65 | 9.19 | 0.29 | 0.08 | 0.12 | 0.30 |

| NC-277 | 37.0 | 38.0 | 18.25 | 0.04 | 2.02 | 12.65 | 0.31 | 0.22 | 0.16 | 0.44 |

| NC-278 | 38.0 | 39.0 | 11.15 | 0.04 | 0.46 | 13.65 | 0.36 | 0.22 | 0.08 | 0.40 |

| NC-279 | 39.0 | 40.0 | 10.90 | 0.03 | 3.65 | 14.20 | 0.54 | 0.24 | 0.27 | 0.36 |

| NC-280 | 40.0 | 41.0 | 11.15 | 0.03 | 2.46 | 12.70 | 0.40 | 0.18 | 0.16 | 0.32 |

| NC-281* | 41.0 | 42.0 | 9.36 | 0.03 | 0.88 | 7.73 | 0.31 | 0.17 | 0.11 | 0.49 |

| NC-282* | 42.0 | 43.0 | 4.26 | 0.04 | 0.52 | 5.13 | 0.27 | 0.11 | 0.08 | 0.58 |

| NC-283* | 43.0 | 44.0 | 1.72 | 0.04 | 0.13 | 5.56 | 0.14 | 0.08 | 0.06 | 0.60 |

| NC-284* | 44.0 | 45.0 | 5.78 | 0.05 | 0.47 | 7.43 | 0.49 | 0.15 | 0.12 | 0.51 |

| NC-285* | 45.0 | 46.0 | 3.14 | 0.04 | 1.06 | 7.44 | 0.49 | 0.14 | 0.08 | 0.48 |

| NC-286* | 46.0 | 47.0 | 2.21 | 0.03 | 0.57 | 6.30 | 0.37 | 0.11 | 0.10 | 0.49 |

| NC-287* | 47.0 | 48.0 | 0.20 | 0.02 | 0.13 | 3.96 | 0.09 | 0.06 | 0.06 | 0.51 |

| NC-288* | 48.0 | 49.0 | 0.10 | 0.04 | 0.16 | 2.79 | 0.08 | 0.05 | 0.08 | 0.45 |

| NO SAMPLE | 49.0 | 54.8 | na | na | na | Na | na | na | na | na |

| NC-289* | 54.8 | 55.8 | 2.80 | 0.01 | 0.07 | 0.78 | 0.06 | 0.03 | 0.03 | 0.15 |

| NC-290* | 55.8 | 56.8 | 1.36 | 0.01 | 0.03 | 0.54 | 0.03 | 0.02 | 0.02 | 0.08 |

| NC-291* | 56.8 | 57.8 | 2.19 | 0.01 | 0.11 | 0.56 | 0.04 | 0.03 | 0.01 | 0.06 |

| NC-292* | 57.8 | 58.8 | 2.51 | 0.02 | 0.40 | 1.12 | 0.09 | 0.06 | 0.06 | 0.26 |

| NC-293* | 58.8 | 59.8 | 23.80 | 0.04 | 0.49 | 1.40 | 0.29 | 0.10 | 0.10 | 0.43 |

| NC-294* | 59.8 | 60.8 | 26.20 | 0.04 | 1.01 | 1.08 | 0.28 | 0.05 | 0.06 | 0.37 |

| NC-295* | 60.8 | 61.8 | 18.90 | 0.05 | 1.17 | 1.87 | 0.19 | 0.14 | 0.11 | 0.49 |

| NC-296* | 61.8 | 62.8 | 23.20 | 0.02 | 0.05 | 2.65 | 0.37 | 0.17 | 0.09 | 0.35 |

| NC-297* | 62.8 | 63.8 | 2.19 | 0.00 | 0.01 | 0.17 | 0.01 | 0.01 | 0.00 | 0.03 |

| NC-298* | 63.8 | 64.4 | 0.60 | 0.00 | 0.01 | 0.11 | 0.01 | 0.00 | 0.00 | 0.01 |

Regional Potential of the Melville Critical Metals Belt

Exploration on the Melville Peninsula has historically been limited to zinc exploration (1970s & 1990s) and isolated gold exploration. The Company's work is revealing a much larger, overlooked critical metals system associated with the Penrhyn Basin's geological evolution. This suggests the region holds potential for large-scale critical metals deposits, positioning StrategX as a pioneer in unlocking its value.

Next Steps

- Drilling high priority targets at Nagvaak to define high-grade graphite mineralization at depth and along strike.

- Comparative studies of world-class graphite deposits to assess economic potential.

- Field evaluation of geophysical and geochemical anomalies across the Melville Critical Metals Belt to identify additional graphite and critical metal targets.

- Follow-up exploration, including ground geophysics, detailed sampling, and mapping, to prioritize drill targets.

- Additional petrographic & metallurgical studies to confirm the high quality and value of the graphite.

Graphite: A Critical Material for the Energy Transition

Graphite is a critical material in the shift toward sustainable energy solutions. It is a key component in lithium-ion batteries, which power electric vehicles (EVs) and store renewable energy from sources like solar and wind. Additionally, its high conductivity, thermal stability, and durability make it essential for fuel cells and other advanced energy technologies. As global demand for clean energy grows, graphite's role in improving energy storage, efficiency, and sustainability becomes increasingly important. Benchmark Minerals Intelligence estimates that approximately 97 new natural graphite mines need to come online by 2035. Graphite represents the largest component of the batteries, and there is no current replacement for graphite in the anode. In addition to the grade and size of deposits, graphite quality is important. Specifically, flake size, shape and purity are key determinants for value per tonne and ease of processing.

As of February 2025, the graphite market is experiencing significant shifts in supply and demand dynamics, influenced by geopolitical events, production challenges, and the accelerating transition to green energy.

Qualified Person

The geological and technical data contained in this press release were reviewed and approved by the Vice President - Exploration for the Company, Gary Wong, P.Eng., a qualified person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects.

Analytical Methods & QA/QC

The analytical work reported herein was performed by ALS Global ("ALS"), Vancouver, Canada. ALS is an ISO-IEC 17025:2017 and ISO 9001:2015 accredited geo analytical laboratory and is independent of the Company and the QP.

All core samples were of historically sawn half-core and no verification of the original sawing and sampling techniques, or core recovery calculations were possible. The samples taken were of pre-existing half-core and submitted to ALS Geochemistry for analysis. Samples were crushed entirely to 70% passing - 2mm, 250g split off and pulverized to better than 85% passing 75 microns. Multi-Element Ultra Trace uses a four-acid digestion performed on a 0.25g sample to quantitatively dissolve most geological materials culminating in analytical analysis performed with a combination of ICP-AES and ICP-MS (method ME-MS61). From there, either PGM-ICP23 or Au-ICP21 was used, depending on whether platinum group metals were suspected. Both methods use a 30g lead fire assay with ICP-AES finish. Graphitic C is determined by digesting a sample in 50% HCl to evolve carbonate as CO2. The residue is filtered, washed, dried, and then roasted at 425C. The roasted residue is analyzed for carbon by oxidation, induction furnace and infrared spectroscopy. No field QA/QC samples (blanks, duplicates, and standards) were inserted because appropriate QA/QC samples are still being sourced.

About StrategX

StrategX is an exploration company focused on discovering critical metals in northern Canada. With projects on the East Arm of the Great Slave Lake (Northwest Territories) and the Melville Peninsula (Nunavut), the Company is pioneering new district-scale discoveries in these underexplored regions. By integrating historical data with modern exploration techniques, StrategX provides investors with a unique opportunity to participate in the discovery of essential metals crucial to electrification, global green energy, and supply chain security.

On Behalf of the Board of Directors

Darren G. Bahrey

CEO, President & Director

For further information, please contact:

StrategX Elements Corp.

info@strategXcorp.com

Phone: 604.379.5515

For further information about the Company, please visit our website at www.strategXcorp.com

Neither the Canadian Securities Exchange nor its regulation services accept responsibility for the adequacy or accuracy of this release.

Disclaimer for Forward-Looking Information

All statements included in this press release that address activities, events, or developments that the Company expects, believes, or anticipates will or may occur in the future are forward-looking statements. These forward-looking statements involve numerous assumptions made by the Company based on its experience, perception of historical trends, current conditions, expected future developments and other factors it believes are appropriate in the circumstances. In addition, these statements involve substantial known and unknown risks and uncertainties that contribute to the possibility that the predictions, forecasts, projections, and other forward-looking statements will prove inaccurate, certain of which are beyond the Company's control. Readers should not place undue reliance on forward-looking statements. Except as required by law, the Company does not intend to revise or update these forward-looking statements after the date hereof or revise them to reflect the occurrence of future unanticipated events.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/243029

News Provided by Newsfile via QuoteMedia

Latest News

CuFe Limited Investor Kit

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Latest Press Releases

Related News

TOP STOCKS

Investing News Network websites or approved third-party tools use cookies. Please refer to the cookie policy for collected data, privacy and GDPR compliance. By continuing to browse the site, you agree to our use of cookies.