Business Sectors

Events

Contents

Shipowners can get the best value out of their projects by choosing the right partnerSponsored by TGE Marine

Register to read more articles.

Record-high LNG imports in Greece amid declining Russian pipeline gas flows to Europe

Greek LNG imports soared to an all-time high in the first month of 2025, with analysts attributing this surge to declining Russian pipeline gas flows to Europe and the need to secure alternative supplies

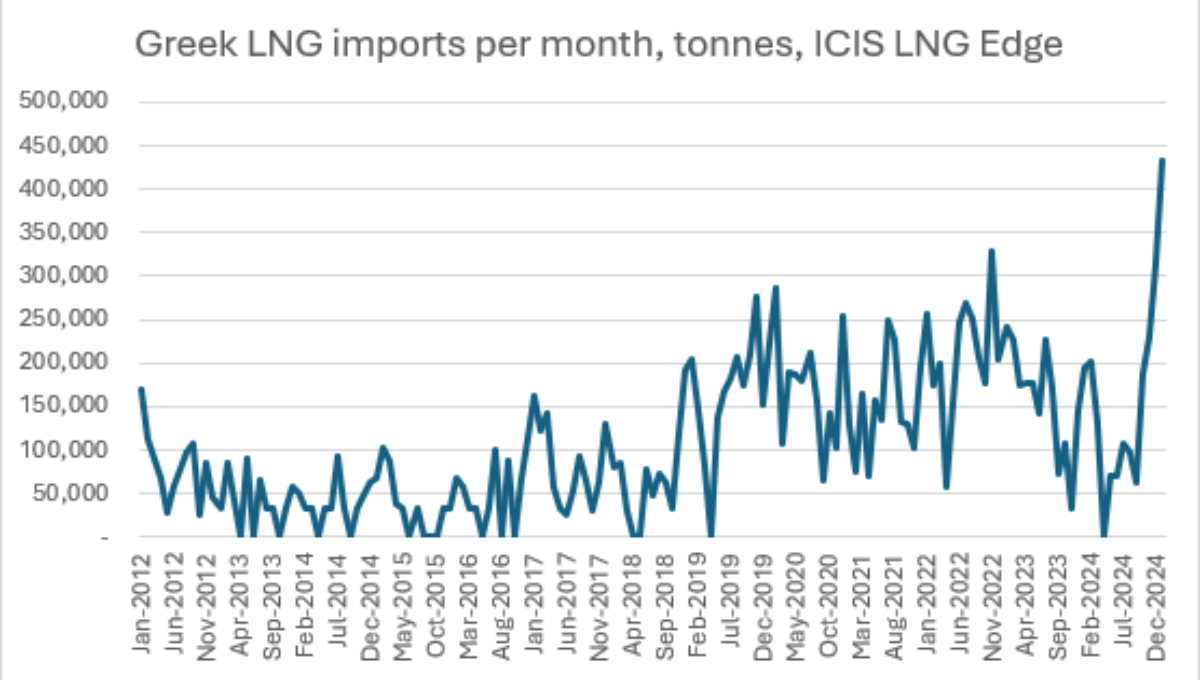

ICIS senior LNG analyst Alex Froley told Riviera Greece imported six LNG cargoes in January 2025, totalling approximately 430,000 tonnes, “which we see as a record high.” He noted all six cargoes originated from the US, with five delivered to the longstanding Revithoussa terminal and one to the newly operational Alexandroupolis terminal in northern Greece.

According to ICIS historical data, this marks Greece’s highest LNG import volume since November 2022, when the country received 328,544 tonnes. In comparison, December 2024 saw imports of 313,860 tonnes.

Greece and Turkey see increased activity

Explaining the factors behind this surge, Mr Froley noted Greek LNG imports had declined in 2024 compared with the levels seen in 2022–2023. “The sudden spike in activity is likely linked to further cuts in Russian pipeline gas flows to Europe,” he added.

On New Year’s Day, Russia halted gas flows through Ukraine to Slovakia following the expiration of a transport agreement between Russia and Ukraine. “This meant the loss of approximately 40M m3 per day, or 15Bn m3 per year, of gas supplies to eastern Europe, mainly used by Slovakia, Hungary and Austria,” Mr Froley explained.

“One way to replace these volumes is to increase LNG imports into Greece and Turkey, regasify the shipments, and transport the gas northward via pipelines through Bulgaria and Romania. This should drive higher LNG imports into both Greece and Turkey,” he said.

Ship diversions

The ICIS LNG Edge ship-tracking platform indicates several LNG carriers that were heading from the US to Asia have altered course in the mid-Atlantic this month, instead signalling destinations in Greece or Turkey.

“For example, LNG Juno, which departed from the US Freeport facility on 20 January, was originally en route to Senboku, Japan. However, it recently changed course, diverting northward in the Atlantic. It is now expected to arrive at the Revithoussa terminal in Greece on 12 February,” Mr Froley pointed out.

Greek LNG imports in 2024

According to Greece’s National Natural Gas System Operator (DESFA), the Revithoussa terminal accounted for 26.4% of the country’s natural gas imports in 2024, while the Alexandroupolis terminal contributed 3.9%.

LNG unloadings at Revithoussa totalled approximately 18.69 TWh from 27 tankers, a decline from 28.52 TWh from 41 tankers in 2023. The United States remained Greece’s leading LNG supplier, delivering 13.89 TWh (71.6%) via 19 tankers, up from 10.75 TWh from 17 tankers in 2023. Russia ranked second with 2.86 TWh (15.3%), marking a significant 65.9% drop in volume compared with the previous year.

The Alexandroupolis LNG terminal, which consists of an FSRU and a subsea and onshore natural gas pipeline connecting it to the National Natural Gas Transmission System, commenced commercial operations in October 2024. The terminal is expected to supply natural gas to Greece and neighboring countries, including Bulgaria, Romania, North Macedonia, Serbia, Moldova and Ukraine, as well as Hungary and Slovakia.

Sign up for Riviera’s series of technical and operational webinars and conferences:

- Register to attend by visiting our events page.

- Watch recordings from all of our webinars in the webinar library.

Related to this Story

Events

Carbon Capture and Storage Webinar Week

Marine Fuels Webinar Week

Bulk Carrier Webinar Week

Maritime Decarbonisation Conference, Asia 2025

© 2024 Riviera Maritime Media Ltd.