Environmentalists protest in front of Sempra headquarters

Demonstration occurs on same day as Sempra’s annual shareholders meeting.

A group of about 25 environmentalists gathered Friday morning in front of the headquarters of Sempra, the Fortune 500 energy company based in San Diego, protesting the company’s use of natural gas and the rates charged by San Diego Gas & Electric, one of Sempra’s subsidiaries.

The demonstration coincided with Sempra’s annual shareholders meeting.

“Sempra is the parent company of SDG&E and has been overcharging San Diego ratepayers, using their monopoly for decades and building a fracked-gas-methane empire of energy infrastructure to basically stop us from transitioning to a renewable world, make huge profits that we pay for (and) sell all this gas to Europe and Asia,” said Scott Kelley of SanDiego350. “It’s an absolute climate disaster.”

A spokeswoman for Sempra said, “We respect the right of demonstrators to express their views peacefully.”

As for utility rates, the spokeswoman said, “SDG&E is keenly focused on addressing energy affordability while building a safer, stronger energy system that can withstand climate threats and accommodate a growing amount of renewable energy, battery storage, and electrified transportation and buildings as California aims to reach carbon neutrality by 2045.”

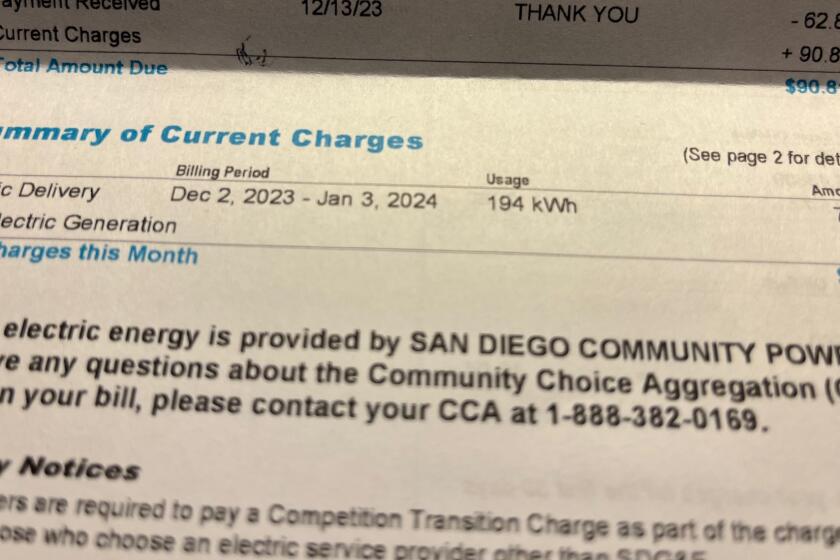

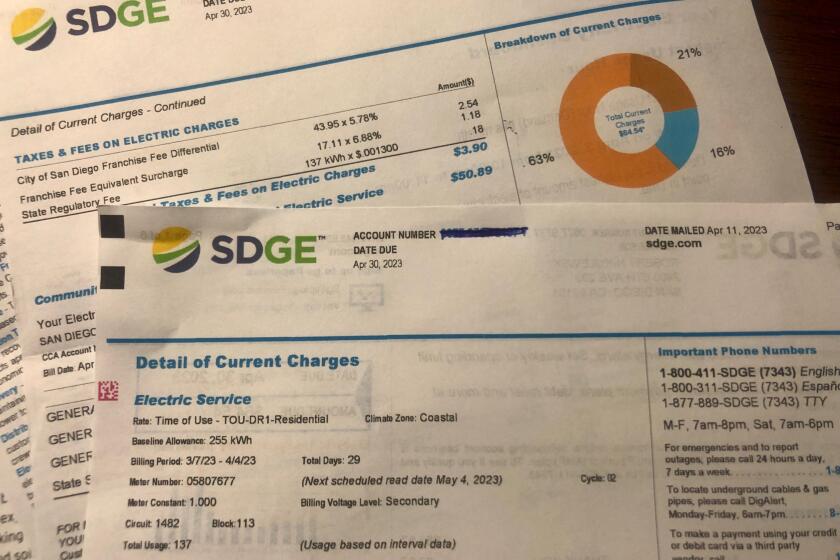

SDG&E raised its rates at the start of this year, with the class average for residential customers climbing 7.8 percent and the average price per therm for customers with natural gas hookups rising 24.6 percent compared to the previous year.

According to the U.S. Bureau of Labor Statistics, the San Diego region had the highest average energy price in the country in January through April.

SDG&E has long charged higher rates than the two other big investor-owned utilities in California — Pacific Gas & Electric and Southern California Edison — and has cited a number of reasons why, including:

- having fewer commercial and industrial sectors than PG&E and Edison, who make up a larger share of the energy load than residential customers, and

- having about 60 percent of its circuits and wires below ground, which are more expensive. The national industry average is about 40 percent.

Sempra has become a major player in the liquefied natural gas, or LNG, export market.

Its $10 billion Cameron LNG facility opened in 2019 on the Louisiana Gulf Coast, sending cargoes to clients around the world. The company is in the process of building an export facility near Ensenada in Baja California and has plans to build two more — another in Mexico and one in Port Arthur, Texas.

LNG has taken on a higher profile in the wake of Russia’s invasion of Ukraine.

Russia is Europe’s largest single supplier of natural gas and LNG exporters have stepped up shipments to Europe in recent months to help displace Russian gas. President Joe Biden on March 27 committed the U.S. liquefied natural gas industry to supply an additional 15 billion cubic tons of LNG to the Continent through the remainder of 2022.

Export facilities take natural gas via pipeline, cool it to minus-260 degrees Fahrenheit, load the liquefied product onto specially made cargo tanks on double-hulled ships that take the LNG to markets around the world.

Since natural gas burns about twice as clean as coal, supporters of LNG say it’s an effective and environmentally friendlier option. But environmental groups oppose exporting LNG, saying it extends the use of fossil fuels and threatens the goal set by the 2015 Paris Climate Treaty to hold global warming to 1.5 degrees Celsius, or 2.7 degrees Fahrenheit, by 2100.

Get U-T Business in your inbox on Mondays

Get ready for your week with the week’s top business stories from San Diego and California, in your inbox Monday mornings.

You may occasionally receive promotional content from the San Diego Union-Tribune.